Table of Contents

Introduction

Corporate risk management is defined as the process that identifies, quantifies, and manages the potential risks faced by a corporation. A corporation may face a number of risks striking with different strengths and efficiency. The potential risks involves: uncertainties arising from corporation strategic failures, daily functional failures, financial management shortcomings, uncertainties arising from unexpected market returns or market imperfections, environmental risks as well as but not limited to measures and standards of the regulations. Corporate risk management is, therefore, a vital area with regard to formulation of hedging strategies. In this write up, the problems facing industries, analysis of the cases involved and recommendations based on possible solution of the problems are addressed with regard to the R.J. Reynolds Industries.

We can do it today.

Background of the industry

R.J. Reynolds Industries is one of the major international consumer based company dealing with tobacco brands, various food stuffs and a number of beverages. The company has its headquarters located in Winston Salem in North Carolina and it sells its products in over 160 states worldwide. All its four tobacco brands, namely: Camel, Winston, Salem and Vantage, were among the top ten best-selling domestic brands in US by 1984. R.J. Reynolds Industries operate food and beverage markets through Del Monte, Heublein and Kentucky Fried Chicken subsidiaries (Kester and Allen, 14).

Problems Facing the Company

The first case about the R.J. Reynolds Industries problem is associated with tobacco market. In the earlier years (before 1952) before researches linked lung cancer, heart and circulation as well as respiratory related deaths to smoking, the company made huge chunks of profit from tobacco alone. However, since then, the adverts from both international and state health agencies such as World Health Organization (WHO) diverted quite a number of possible customers thus resulting in a general drop in revenue. In addition, it became a public knowledge that tobacco is indeed a drug and thus the company was to some extent responsible for smoking related deaths. In UK, for example, the state health authority estimated smoking related annual death to be about 121,000. This has the effect of keeping away the experts in such fields, especially the strong religious believers, for fear of being indirectly responsible causing death of thousands of tobacco users annually (Kester and Allen, 2).

The other problem that faced the company was strong competition from other companies dealing with similar products. This mainly affected food and beverage cases. For example, the emergence of the great Coca Cola Company dealing with cheap, reliable, easily accessible and equally healthy beverages diverted a number of initial customers, consequently, resulting in a reduced revenue. Other potential risks faced by the company entail: exchange rate risks, interest rate risk, and commodity price volatility risk

Analysis of the Cases

Assumptions

There is no unique definition of the term corporate risk management. Different scholars define the term differently depending either on their scope, level and or the case in which it is applied. According to Muelbroek (33), the definition of corporate risk management encompasses three major entities, namely: corporate operations, general capital structure and financial structure. This write up considers the definition based on the financial flow and assumes that the hedging mechanism should strive to maximize financial inflow and minimize the outflow in order to maximize the accrued revenue.

Relevant data from the case

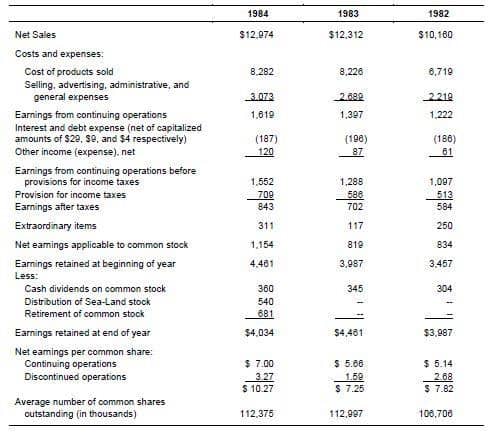

According to Kester and Allen (14), R.J. Reynolds Company was ranked 23rd among 500 list of companies in 1984following sales and net income for that year. Sales from tobacco only accounted for 58% of revenues and 75% of income while food and beverages accounted for 36% and 22% of revenue and income respectively (see table 1).

Table 1: Consolidated statement of net income and revenue of R.J. Reynolds Industries comparison between 1982 and 1984- in millions- (Adapted from Kester and Allen, 14)

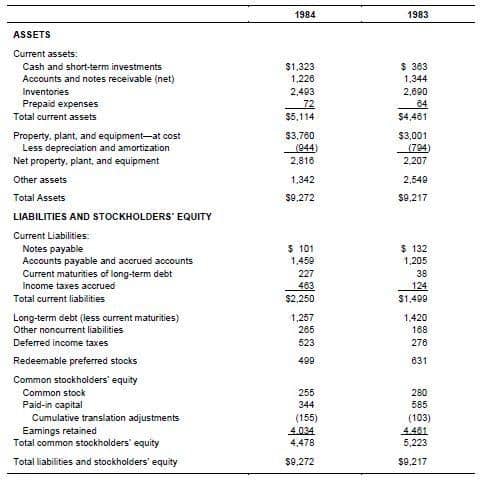

The assets and liabilities comparison was also made between 1983-1984 by Kester and Allen (14), as shown in table 2. The table shows that the sales of energy operations, cash and investment increased to more than three times from the values in 1983 to the value in 1984. The table also shows that long term debts decreased by an appreciable value from 1983 value to the relatively lower value in 1984.

Table 2: Consolidated balance sheet as at 31st December- comparison between 1983 and 1984. (Adapted from Kester and Allen, 14)

Theoretical analysis of the R.J. Reynolds Industries case

Shareholder Wealth Maximization Theory

According to this theory, the motives of corporate risk management is to ensure maximization of wealth mainly through such operations and practices that minimizes expenses at all costs (Auerbach and Alan, 440: Poitras and Geoffrey, 129; Stulz et al., 1022). Such expense minimization parameters include: tax savings, avoidance of under investments and financial distress among other cost minimization parameters. From table 1, it becomes clear that the through the theory of wealth maximization, net sales improved drastically from 1982 all through to 1984. Even though the theory focuses in expense minimization in order to maximize revenue, it should be made clear that only unnecessary expenses are to be avoided at all cost. However, marginal expenses that would result in additional extra revenue should be adhered to. For example, in table 1, the total expense incurred in 1984 was relatively higher than that incurred in 1983 and 1982, nevertheless, the extra income realized as a result of additional expense is far much more than the expense incurred.

Similarly from table 2, the company through effective risk management system is keen on maximizing the revenue. For instance, in 1983total current assets is less than that in 1984 while at the same time, the total liability was higher in 1983 as compared to 1984. This shows that the company became more profitable in 1984 than 1983.

Recommendations

Based on the major problems affecting the company, this write up suggests the following recommendations. The first problem dealing with deaths of tobacco users can be dealt with by the company through research in the field to come up with a brand that is health friendly. The only challenge in this recommendation is that the main ingredient that can make tobacco is the one that makes tobacco unhealthy. However, further research can come up with a way in which this unhealthy ingredient can be dealt with by the body to prolong the user’s life. Problem of competition can be handled through careful SWOT and PESTEL analysis of the competitors with the main aim of making the company outstanding among others.

- Auerbach, Alan J. “Wealth maximization and the cost of capital.” The Quarterly Journal of Economics 93.3 (1979): 433-446.

- Malmendier, Ulrike, and Geoffrey Tate. “Who makes acquisitions? CEO overconfidence and the market’s reaction.” Journal of financial Economics 89.1 (2008): 20-43.

- Poitras, Geoffrey. “Shareholder wealth maximization, business ethics and social responsibility.” Journal of Business Ethics 13.2 (1994): 125-134.

- Stulz, René M., and Walter Wasserfallen. “Foreign equity investment restrictions, capital flight, and shareholder wealth maximization: Theory and evidence.” Review of financial studies 8.4 (1995): 1019-1057.

- Carl Kester; William B. Allen. “R.J. Reynolds International Financing.” Harvard Business School. 287057-PDF-ENG. (1987): 14. Accessed on 27/01/2017