Table of Contents

ABSTRACT

The choice that is there between the domestic goods and foreign products depends majorly on the real exchange rate. Additionally, the choice also between the domestic assets and foreign assets primarily depends on the relative rates of return that depends on the domestic interest rates, on the expected depreciation or appreciation of the local currency and the foreign interest rates. The real exchange rate is dependent on the nominal exchange rate (E), the home price level (P) and also the foreign price level denoted as (P*). Furthermore, the balance of payments (BOP) summarizes the transactions of a country with those of the rest of the world, and it is made up of two components: the current account and the capital account. For there to exist a balance, the goods in the market require the demand for the domestic products to equal the production of the same domestic goods: Y=Z. In the short run, production responds to the idea of one-for-one to the changes in demand with no change in the prices.

INTRODUCTION

Openness in Goods Markets

Openness in goods markets implies that the domestic residents can buy foreign goods and sell domestic goods globally. The difference that exists between the imports and exports called trade balance. If a trade balance is negative, it is called a trade deficit and if it is positive it is called a trade surplus. In any closed economy model, the domestic residents can only make a single decision, and that is how much they spend (Banerjee, et al., Pg. 275-297). On the other hand, in an open an open economy, the domestic residents can make two decisions: the much they spend and the much they spend on local goods as opposed to foreign goods. The last decision is mostly influenced by the real exchange rate and also the relative price of foreign goods.

Furthermore, the real exchange rate is dependent on the nominal exchange rate (E), the home price level (P) and also the foreign price level denoted as (P*). A nominal exchange rate is the home currency price of the exchange. It is critical to understand that an increase in the exchange rate will imply that the home currency will lose value which is known as currency depreciation. Therefore, a devaluation or the appreciation of the home currency means that there is an increase or a decrease in E consecutively.

The real exchange rate (ε) is give as:

ε=EP*/P

Openness in Financial Markets

The transparency in the financial markets means that the domestic residents can exchange assets i.e. bonds, money, and stocks with its residents. It means that there is a tie that exists between the trade in goods and the trade in goods. The trade in assets allows states to borrow from each other. Therefore, the states which run the trade deficits can be able to finance them through borrowing from countries which run the trade surpluses (Banerjee, et al., Pg. 275-297).

Furthermore, the balance of payments (BOP) summarizes the transactions of a country with those of the rest of the world, and it is made up of two components: the current account and the capital account. A current account is a summation of the transfers, the net investment income that is received from other countries and trade balances. In that regard, the current account is substantially a record of the net income that is received from the world. On the other hand, the capital account is responsible for the measure of the purchase and the sale of foreign assets or just the net decrease in the foreign assets. Apart from just a statistical discrepancy, the capital account and current account sum to zero by construction.

The capital account is in charge of measuring a country’s aggregate financial transactions with the world. Nonetheless, individual investment decisions are administered by relative returns on foreign and home assets. The underlying assumption is that the private residents do not utilize foreign currency in purchasing goods hence a transactions motive for the domestic residents in holding foreign currency do not exist. Additionally, the stocks and the bonds are perfect substitutes which then limits attention to the foreign and home bonds.

OUTPUT, THE INTEREST RATE, AND THE EXCHANGE RATE

Equilibrium Output and the Trade Balance

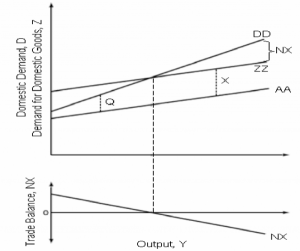

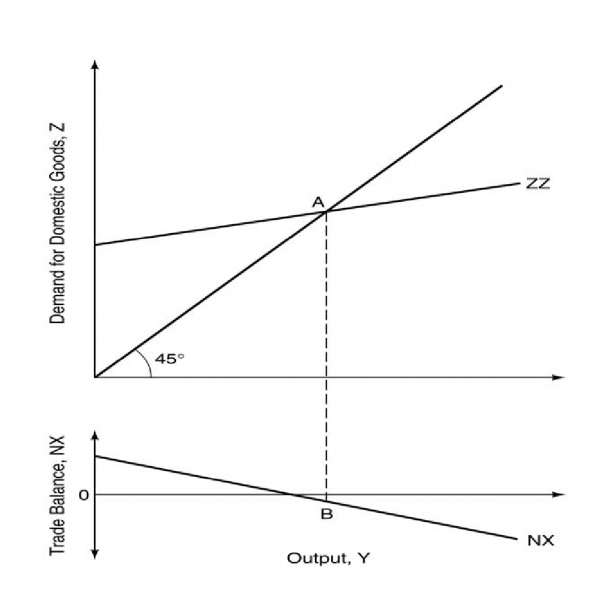

For there to exist a balance, the goods in the market require the demand for the domestic products to equal the production of the same domestic goods: Y=Z. In the short run, production responds to the idea of one-for-one to the changes in demand with no change in the prices. In a graphical representation, equilibrium is determined by an intersection of the ZZ curve and the 45°- line as in Figure 1. The equilibrium does not need balanced trade.

Figure 1: The Demand for the Domestic Goods and the Trade Balance (NX)

Increases in Demand, Foreign or Domestic

In case the domestic demand increases (e.g., T decreases, consumer confidence increases or G increases) the ZZ curve will shift up; thus, the output increases and then the trade surplus will fall. Further, if the foreign demand (Y*) increases, then the NX and ZZ curves will shift up by the same magnitude. Then output with the trade surplus will also increase. Furthermore, the increase in the imports which arise from an increase in the home production does not entirely positively offset the effect on the exports from the growth in demand from for foreign goods.

Consequently, the relationship which lies between the external and home output bears a suggestion that the policy coordination can be critical when the industrial states as a group operate below the normal levels of production. However, the Governments do not like to run such trade deficits because these deficits require borrowing. If the coordinated action is not there, then an expansionary policy by a country in the midst of a global recession will likely lead to a trade deficit (Aizenman, Pg. 444-460). The reason is that the increase in the income will give rise to an increase in the imports and the coordinated expansions will then tend to bear less effect on the trade balances in the individual countries. In that line, the countries which have budget deficits may develop a tendency of unwillingness to consider the expansionary fiscal policy. Additionally, once the agreement has been negotiated, then every country has an incentive to renege which means that they will hope to benefit from these expansions abroad and also improve the trade balances.

Figure 2: The Equilibrium Output and Trade Balance (NX)

Depreciation, Output and the Trade Balance

The trade balance (NX) is denoted by:

NX=X(Y*,ε)-εQ(Y,ε )

Any form of real depreciation has two effects: the quantity effect which is an increase in the exports and also reduction in the imports, which has a tendency of increasing the trade balances, and also the price effect. The price effect is an increase in the price of imports relatively which tends to lead to a reduction in the trade balances. Therefore, the net effect will be positive if the Marshall-Lerner condition is satisfied (Bahmani, et al., Pg. 411-443). Thus, a real depreciation will then improve the trade balances and also lead to an increase in the output.

If a government can affect the real exchange rate via policies, then it has the ability utilize fiscal policy and the real exchange rate for purposes of achieving output and the trade balance. Consequently, an expansionary monetary policy can increase the output, but it can also worsen the trade deficit. Furthermore, a real depreciation can increase the output and then improve the trade deficits. However, there is no guarantee that it will achieve the production target. For purposes of meeting both targets, the policymakers have to implement a policy mix which means that they would engineer a real depreciation that will be sufficient to balance trade at the target output level and also use the fiscal policy in ensuring that the economy achieves the target output level.

The J-Curve

The effects of the real depreciation have a dimension that is dynamic in nature. The price effects happen immediately, but the aspect of quantity results takes some time, and the result is that the trade balance has a tendency of worsening quickly after the real depreciation, but it improves with time. The adjustment at the time of the trade balance is a shortfall which is followed by a gradual improvement which is called the J-curve (Bahmani, et al., Pg. 411-443). An econometric evidence suggests that in very developed countries, the trade balances improve between the first six months and 12 months after a real depreciation.

Saving, Trade Deficits and Investment

The national income identity equation is expressed as:

NX=Y-C-I-G=(S-I)+(T-G),

Where the private saving (S) is denoted by S=Y-C-T.

The first equality in the equation portrays that the trade balance is equal to the income minus the spending. Consequently, the second parity equation demonstrates that the trade balances were the excess of the private savings over the investment adding the government budget surpluses. The ignorance of the distinction which exists between the trade balance and current account, a trade surpluses means that a country is lending to the world.

Equilibrium in the Goods Market

In consideration, NX=X(Y,ε)-εQ(Y,ε), then the goods market equilibrium condition can be depicted as:

Y=C(Y-T)+I(Y,r)+G+NX(Y,Y*,ε)

In the short run, the assumption is that P and P* are fixed, and concerning convenience, it is equal to one, and in that line, E=ε.

Since P is fixed, the assumption will be that the expected inflation is zero, that r=i. Under these circumstances, the goods market equilibrium will be:

Y=C(Y-T)+I(Y,i)+G+NX(Y,Y*,E).

Equilibrium in Financial Markets

The foreign currency is under the assumption that there are no transactions value for the domestic residents; therefore, the choice which lies between the local money and the bonds can be summarized by an LM relation:

M=YL(i),

If we assume that perfect asset substitutability and the perfect capital mobility, then the choice between the domestic and the foreign bonds is captured by the condition of uncovered interest parity:

it=i*t+(Ee

t+1-Et)/ Et.

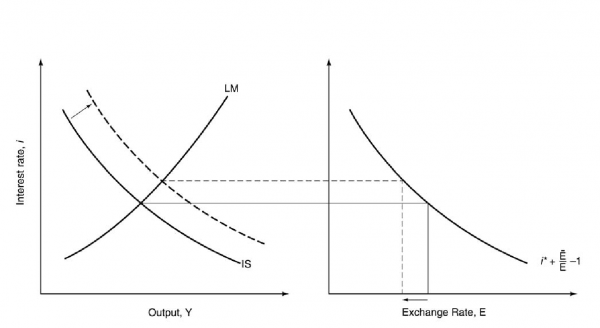

In this section, the underlying assumption is that the expected future exchange rate is fixed at E and dropping the time subscripts, then the uncovered interest parity is:

E= E /(1+i-i*).

Looking at the expected exchange rate, in case the home-foreign interest differential soars, then the home assets become attractive, and the home currency appreciates when E falls till the expected depreciation equals the benefits differential; therefore, the returns on the home and foreign assets are equalized.

The Effects of Policy in an Open Economy

The outcomes of an increase in the government spending can be depicted graphically like in Figure 3 below. Furthermore, the curve on the left shows the IS-LM curves. The curve on the right portrays the uncovered interest parity condition. If there is an increase in the government spending, then there will be a shift in the IS curve rightward which will cause the output, and the interest rates will increase. Since the expected future exchange rates are fixed, then the uncovered interest parity equation bears the implication that the exchange rate appreciates when E falls (Banerjee, et al., Pg. 275-297). Further, the increase in the output and the appreciation of these exchange rates work to lead to a reduction in the trade balance. The effect that it will be on the investment is ambiguous since the output effect has a tendency to increase the investment, but the interest rate effect tends to reduce it.

Figure 3: The Expansionary Fiscal Policy in the Open Economy with Floating Exchange Rates

A reduction in the monetary supply will shift the LM curve leftward. Furthermore, the output will fall, then the interest rates will increase, and finally the exchange rates will appreciate. The investments fall, but the outcome on the trade balance is very ambiguous since the fall in the outputs have a tendency to increase it, but then the exchange rate appreciation reduces it (Aizenman, Pg. 444-460).

CONCLUSION

Openness in goods markets makes it possible for people and firms to choose between foreign and domestic products. The transparency of financial markets makes it possible for financial investors to hold the local financial assets or any of the foreign financial assets. Furthermore, the real exchange rate is the relative price of a domestic product about foreign goods. It equates the nominal exchange rate times which the international price levels divide the local price levels. In addition to that, the balance of payments records a state’s transactions with the globe. Therefore, the current account balance equates the sum of the trade balance, net transfers received from the world and the net investment income. Nonetheless, the capital account balance is equal to the capital flows from the rest of the globe subtracting the capital flows.

- Aizenman, Joshua. “Internationalization of the RMB, Capital Market Openness and Financial Reforms in China.” Pacific Economic Review 20.3 (2015): 444-460.

- Bahmani, Mohsen, Hanafiah Harvey, and Scott W. Hegerty. “Empirical tests of the Marshall-Lerner condition: a literature review.” Journal of Economic Studies 40.3 (2013): 411-443.

- Banerjee, Ryan, Michael B. Devereux, and Giovanni Lombardo. “Self-oriented monetary policy, global financial markets and excess volatility of international capital flows.” Journal of International Money and Finance 68 (2016): 275-297.