Table of Contents

Company Overview

Currently, I am responsible for selecting the country for my company’s next start-up location. The company is an American cloud computing firm headquartered in California. Although most of the firm’s revenue comes from its customer relationship management (CRM) products, the company also capitalizes on the underlying commercial applications of various social networking platforms. By the end of the fiscal year 2016, the company had been one of the most highly valued cloud computing organizations within the U.S with a market capitalization that exceeded $ 60 billion. The company is a constituent of the S&P 500 Index and is listed on the New York Stock Exchange. The company’s customer relationship management (CRM) services can be broken further into different categories, including sales cloud, commerce cloud, data cloud, service cloud, community cloud, marketing cloud, and analytics cloud. The company’s mission statement notes that the company leverages on people and technology resources to improve societies around the world.

Country 1: the Safe Bet

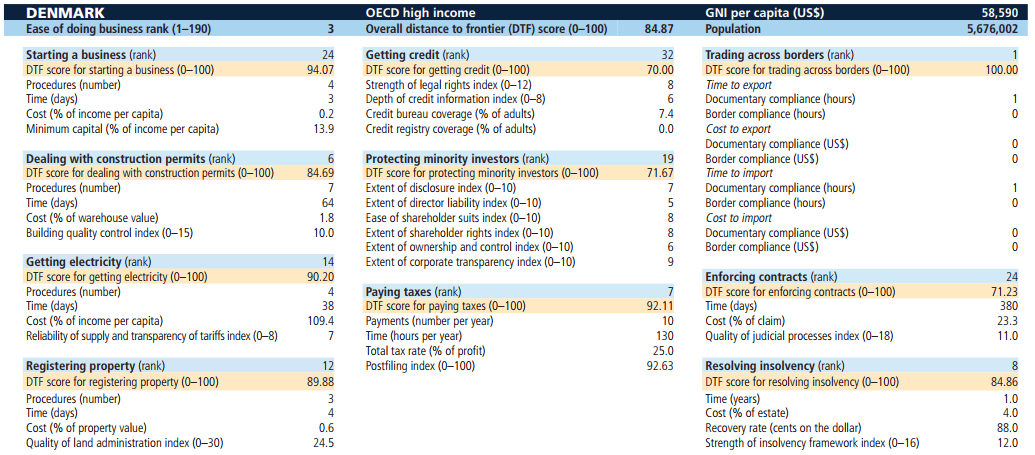

Denmark is the higher ranking country at third position with a distance to frontier DTF score of 84.87 (World Bank Group, 2017). The country’s major trade is industrial machinery accounting for 13.51 percent and 12.30 percent of the total exports and imports respectively (CIA.gov, 2016). Denmark’s report rankings place it third in the ease of doing business index with the overall distance to frontier being 84.87 (World Bank Group, 2017). Table 1 shows Denmark’s DTF ranking.

Table 1. Shows Denmark’s DTF ranking.

(World Bank Group, 2017)

Denmark reached its current position by making easier for investors to acquire construction permits, registering their properties, getting credit, and resolving insolvency issues (World Bank Group, 2017). Currently, Denmark’s roles within the European agricultural and environmental issues, trade agreements, and its strategic location at the Baltic Sea make Copenhagen a commercial center for the U.S.’s private investors and firms seeking to expand to across the Baltic and Nordic region (Sciarelli & Rinaldi, 2017). Therefore, the existing trade agreements will underpin the start-up’s sustainable growth, especially in the long-term.

Country 2: the Risky Adventure

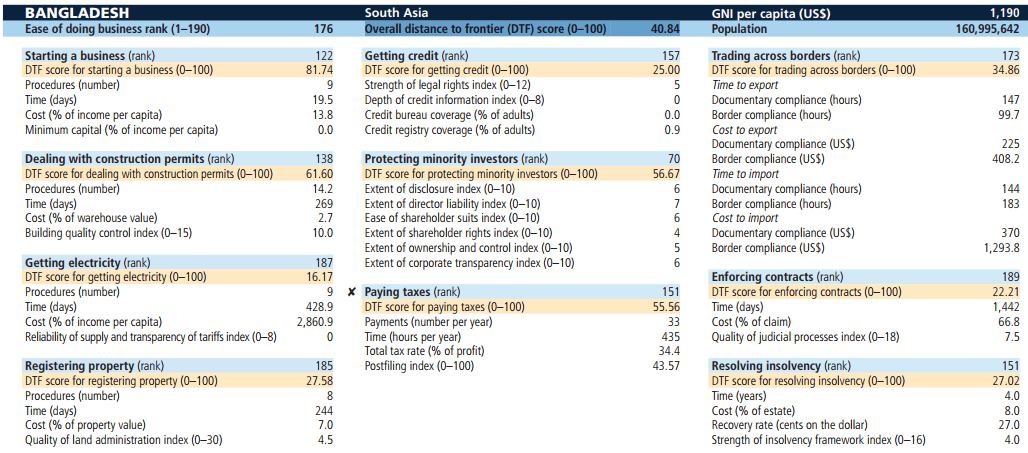

Bangladesh is the lower ranking country with a DTF score 176 and an overall distance to frontier (DTF) score of 40.84 (World Bank Group, 2017). Table 2 shows an analysis of Bangladesh’s report rankings.

Table 2. Shows Bangladesh’s report rankings

(World Bank Group, 2017)

Bangladesh’s major trades involve machinery and equipment, cotton, chemicals, foodstuff, and iron and steel (CIA.gov, 2016). The country got to the low rankings because paying taxes is more costly and its current corporate income tax rates are the highest in the region (World Bank Group, 2017). Bangladesh is currently ranked 151 in the paying taxes index with the DTF score for paying taxes being 56.67 (World Bank Group, 2017). Also, the country increased the cost of obtaining a building permit, thereby making construction permits more expensive for investors. The DTF score for dealing with construction permits is currently 61.60 (World Bank Group, 2017). Bangladesh lacks existing trade agreements with most of the western countries especially the U.S., which is a major deterrent to the start-up costs (Rahman, Akhter, & Saif, 2015).

Country of Choice

This section appraises the major risks associated with starting a new location in both countries to recommend the key actions that the company can take to reduce the risks regardless of the country selected. Four major risks with starting a new location in Denmark can be underscored, for instance, political, technology factors associated with globalization, global marketing management, and high costs of labor. Although Denmark is a stable democracy, the government is led by a small liberal minority coalition, and since the 20th century no party has achieved the required majority to rule (Green-Pedersen, 2010). The underlying risk is that all bills are passed through compromises and bureaucratic negotiations with the government and the opposition parties. Therefore, any emerging trade issues requiring the government’s attention or political lobbying can be difficult and dilatory for the business.

Technology risks, especially those associated with globalization, underpin inequality at the workplace (Sjöberg & Fromm, 2001). The recommendation suggested regarding the key actions that the company can take to reduce the underlying political risks involves mapping the priority threats to establish the appropriate course of actions that leverage on consultations, periodic reporting, and reviews among other risk controls. The approaches ensure the company reviews its code of conduct in Denmark or Bangladesh, which in turn helps in stepping up the local training activities to ensure the employees gain a thorough understanding of the countries’ fundamental rules and laws. The recommendation suggested to mitigate the technology risks involves improving employee training to bridge the inequality gap created by globalization (Sjöberg & Fromm, 2001). Also, the approach is crucial in mitigating the issues associated with global marketing management and the rising high costs of labor due to the movement of human resources across the globe.

The major risks associated with starting a new location in Bangladesh are the political risks. The political risks in Bangladesh are higher than in other regions such as Denmark leading to a lack of investor confidence especially after the terrorist attack in 2016 at the Holey Bakery Restaurant (Kabir, 2016). Also, the lack of political cohesion makes it difficult for the government to articulate strategic trade agreements, especially with the western countries. Currently, Bangladesh made it more difficult to pay taxes for companies by increasing the time it takes to prepare VAT and corporate income tax returns. Lack of qualified labor is another major risk in starting a company in Bangladesh. Over 30 percent of the children are involved in child labor, and the country has the heights drop-out rates and poor quality education in the region (Kabir, 2016). The political risks in Bangladesh can be mitigated through lobbying with key decision makers to ensure the company maintains a strategic position regardless of the underlying political issues. Training the local employees will be crucial in mitigating the risks associated with the lack of qualified labor and disregard for the child and human rights.

Based on the analysis conducted herein, Denmark is the better choice for the company’s next location because its political, technology and human resource risks are few, less costly, and are easily mitigated. On the contrary, Bangladesh has more risks, and the political instability in the region significantly reduces the investors’ confidence. The rewards that will result from starting a new location in Denmark include a stable political and business environment that underpins sustainable growth. The country’s’ current business environment makes it easier for the company to resolve any future insolvency issues, acquire construction permits, register its properties, and get credit. Additionally, Denmark’s existing trade agreements will underpin the start-up’s sustainable growth, especially in the long-term.

- CIA.gov. (2016). Bangladesh.

- CIA.gov. (2016). Denmark.

- Green-Pedersen, C. (2010). The politics of justification: Party competition and welfare-state retrenchment in Denmark and the Netherlands from 1982 to 1998. Amsterdam: Amsterdam University Press.

- Kabir, A. (2016). Terrorism is global, but its causes are not: Action points for Bangladesh following the Dhaka attack.

- Rahman, M., Akhter, K., & Saif, N. G. (2015). Trade and transport facilitation in Bangladesh: An audit of the state of play.

- Sciarelli, F., &Rinaldi, A. (2017).Development Indicators and International Rankings. In Development management of transforming economies (pp. 41-73). London: Palgrave Macmillan UK.

- Sjöberg, L., & Fromm, J. (2001). Information technology risks as seen by the public. Risk Analysis, 21(3), 427-442.

- World Bank Group. (2017). Doing business 2017 equal opportunity for all: Comparing business regulation for domestic firms in 190 Eco. World Bank Report.