Table of Contents

Introduction

Emirates Airlines was established in 1985 by the government of Dubai with only two aircrafts. Currently, the airline is among one of the largest known in the world with tens of thousands of aircraft, which flies to more than 55 destinations in the world. The company is also the largest purchaser of the super-jumbo by investing in more than 45 of the Airbus A380 and other aircraft. In the recent time, it was also recognized as the top five most profitable airlines globally as well as the fastest growing (Balakrishnan, 2008, p.62).

The Airline motherland is Dubai, which is a significant producer of the world’s oil, therefore, it enjoys certain privileges for being based on the oil source (Balakrishnan, 2008, p.62). However, in the recent days, the oil price has deteriorated thus affecting both the airline, the country and the international market. Oil offers the Airline competitive advantage against other airlines such as the British Airlines, Singapore Airlines among others. Therefore, a decrease in world oil price is a major blow for the country, region, and to some extent the airline itself.

External Environment of Emirates Airline

Oil is the most significant factor that affects the industry and makes the company’s economic growth noticeable globally and also competitive regarding world-wide trade, tourism as well as a major investment destination. However, the deteriorating oil price has greatly affected it.

PEST analysis’ impact

Economic impact

The economic factor is vital for the success of any business. In terms of the airline industry, the success will depend on the factors such as technology and the world oil prices. For instance, the oil price will determine whether the company is able to meet its customers’ requirements. Moreover, the developments in the airline not only benefits the company itself but also other players of the economy including the country (Nataraja & Al-Aali, 2011, p. 471).

Cheap oil is a double-edged sword for Emirates. At times when oil is considered to be affordable, the airline is usually involved in huge profits. However, at times when the prices are low, most of its wealthy clients whom the airline largely depend on, limits their spending power. The company is likely to experience a fall in revenue. The organization is forced to look for an alternative class of passengers as most of first class passenger’s reduction is experienced (Nataraja & Al-Aali, 2011, p. 471). Oil has the greatest impact in terms of economy.

Social factor

The regions and the airline also depend on the tourists as their source of income. In this case, the number of tourists is a major social factor of consideration. Reduction in the oil prices has an impact on the passenger’s turnout in the airline ((Nataraja & Al-Aali, 2011, p. 473). The number of tourists and other passengers is likely to reduce as most of the wealthy people seek to explore other destinations since the prices have been reduced. However, in some instances when the number of expatriates increasing it would have an effect of increasing the company’s returns but this case the opposite is more likely.

Technological factor

Technology is mostly influenced by other factors such as the economy, and in this case, oil has an huge effect on the kind of technology the company is likely to employ since it is the backbone of the organization’s success. With the reduction in oil prices, the turnover for tourists and passengers who initially depended on the cheap Emirates airline will reduce thus invention such as the online booking would be affected and other technologically driven services might also be affected resulting in huge losses at the airline (Nataraja & Al-Aali, 2011, P. 473).

Potential risks and cost for the country, region and the business

One of the greatest risks to the organization is based on the low oil prices. The oil price reduction turns around the organization, the region, business and country since they are all dependent on the oil. To start with, low oil price in the world market reduces the competitive advantage that the company has over other similar firms outside that region. To other firms, such are good times when they are likely to make huge profits, but to Emirates, the level of passengers and tourists significantly fall thus impacting its economy. The company’s total earning reduces thus forcing the company to seek alternative ways of improving its returns or maintain its market significance and compete with other companies.

To the country and the region, they are all dependent on the airline’s tourists and passengers to increase their GDP through income generation. However, as the tourists and passengers number reduces so does the income they are likely to generate to the country and also the region. Such economic resources are diverted to other destinations. Additionally, the actual trade of the oil products by the countries of the region is also affected by the global market. In this case, the huge profits that were initially made by the producers also fall meaning that the GDP income is also under the threat of being reduced.

Potential knock on the region and airport retails

The global reduction in the oil prices has a great effect on the oil producers, in this case, the Middle East region. In countries such as Dubai and Saudi Arabia where the most government revenue is generated from oil productions and as the main source of currency, the result of oil price reduction is that economy will have to suffer disproportionally due to falling oil prices (Balakrishnan, 2008, p.62). The region’s currency is also under threat of falling, which in turn would lead to high inflation and gain further trigger consequences such as interest rates increase among others.

On the side of airport retails, as the world is experiencing the slash in oil price, most of the airport’s activities have been affected. For instance, the reduction has forced the UAE to closely monitor the consequences even in the stock market behavior (Balakrishnan, 2008, p.69). In 2014, at the time of oil price reduction, the Dubai stock market sharply decreased its stock index by more than 47 percent from its previous peak. However, some commentators indicate that the effect of the oil price is likely to cause psychological effect rather than an economic one.

Impact on demand and supply

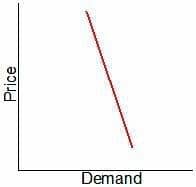

Oil is viewed as an elastic commodity like any other capable of being swayed by demand and supply within a specific market (Baffes et al., 2015, p.11). In other instances, the demand for oil is considered to be inelastic since there a no available substitutes for oil use as fuel. This has an effect of decreasing the quantity of demand. Curve to illustrate the inelasticity is below

Figure 1 oil inelastic demand curve

In this case, the demand for oil is inelastic since the change in a quantity of the oil demanded is lower than the percentage of its price.

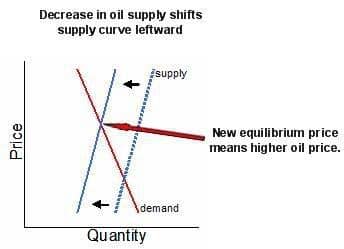

Regarding supply, the same case happens. The supply of oil is also inelastic, which is triggered by the cost associated with its production (Baffes et al., 2015, p.11). For example, during the production of oil, the cost incurred in pumping the oil is constant notwithstanding the fact that oil field running cost is 60% or more. Therefore, the resultant supply curve will be as shown below.

Figure 2 inelastic supply curve

Impact of oil price reduction on Emirates with change in environment

The change in oil price is crucial in the financial aspect of Emirates, but as indicated earlier, the reduction is a double-edged sword for the company ((Balakrishnan, 2008, p.73). At one point, the reduction dictates an affordable running cost of the airline, but as opposed to other Airlines outside the region, it is a time of great turmoil as the number of passengers and tourist depreciates. When other Airlines and great rival of the Emirates are celebrating such reduction, a constant price would have meant better business for it. Not unless the company review its pricing structure, lowering airline’s airfare automatically after a decrease in oil price is disastrous to business. Even if the price is cut, it must be done in consideration to the anticipated profits level. For instance, in some cases, a drop in oil prices reduces tourists traveling by more than 50 percent of the previous peaks.

Long and short term ramifications

Short term

The financial market is among the most affected and sectors that are being shaped by the oil price reduction. The falling of oil price has an effect of damaging the balance sheets of many energy firms by cutting down their reserves that would have otherwise been invested as market assets (Balakrishnan, 2008, p.88).

Secondly, the low price is also deterring cleaner energy sources which are in compliance with the environmental concerns (Balakrishnan, 2008, p.88).This is caused by the high production and upgrading that is associated with the heavy oil reservoirs. In due time, the production is likely to be postponed. However, the optimist is of the opinion that the producers will be encouraged by the changing process to develop more technologically oriented production tools geared towards the renewable source of energy.

Long term

According to Balakrishnan (2008, p.62), within the geopolitical realm, the consequences of low oil price is quite extreme. For instance, the United States and Russia have been in a struggle over Ukraine. Additionally, the relationship between China and Russia has been worsening by this fact. The situation is worsening day after day and might lead to a long-term economic division between nations.

Money devaluation is also a major setback as a consequence of price decrease. If the price decrease remains constant, the Emirates and the entire region would be affected economically, socially and politically as well. The stock market would fall thus shrinking the capitals of the region’s states. Additionally, the export revenue would slowly go down together with the foreign investments (Nataraja & Al-Aali, 2011, p. 480).

We can do it today.

Proactive steps of minimizing impacts

In most cases, the oil producing companies have the risk of managing their volatile commodities. Oil management has become a major concern as most of them look after oil. One of such risks is the involvement of concerned parties in observing time.

Secondly, data quality is very important for both the region and the country’s growth and success. All the information, which involves the oil assets is so important such that information is shared. Provision of correct and high-quality information will always keep the company from the risks (Nataraja & Al-Aali, 2011, p. 483). Moreover, in cases where the information is incorrect, the organization is also likely to be exposed to business regulators fine. Emirates airline as a company needs to make strategic, operation and tactical decisions for it to be successful.

Demand implications

One of the common impacts of demand on oil, when the price is low, is that the price is automatically lowered meaning that the company and the region are likely to suffer from it. The economic condition is among the most affected by demand frustrating most of its demands experts. Additionally, over time as technology is advanced, the cost of production of oil is likely to decrease further, which is a negative implication to demand returns both in the international and local jurisdictions. Further research indicates that if the price is maintained at $60 per barrel, any further increase in the global oil production will cause oil to be uneconomical. In regards to the Airline, the effect of demand will be similar to that of the region economically. However, its performance is likely to deteriorate as a result of low customers (passengers and tourists) turn out and to some extent making it uncompetitive to other Airlines which enjoys the benefits of price reduction

Existing opportunities for the airline

One of the positive sides of the airline in times when the price has been reduced is that, to some extent, it will also enjoy low fuel running cost. However, this should be an opportunity to look for more incentives that would attract more customers such as improving the flight conditions, which would attract more clients hence maximizing the profits. The airline should also consider increasing its flight routes, which currently stands at 55 (Nataraja & Al-Aali, 2011, p. 477). This would be beneficial since it would be able to gather small chunks of profit and channel it towards the main pool.

In conclusion, the cost of fuel has a branched impact not only to the direct user (Emirates) but also to an extended sector, which involves the state, the immediate region, and the international market. For instance, the consequence of oil reduction affects both the economies of Emirates and the global market. Therefore, States needs to take measures while considering what might happen to them too. The airline, on the other hand, must take all measures to maintain its competitive nature by diversifying its activities.

- Baffes, J., Kose, M.A., Ohnsorge, F. and Stocker, M., 2015. The great plunge in oil prices: Causes, consequences, and policy responses. Consequences, and Policy Responses (June 2015).

- Nataraja, S. and Al-Aali, A., 2011. The exceptional performance strategies of Emirate Airlines. Competitiveness Review: An International Business Journal, 21(5), pp.471-486.

- Stephens Balakrishnan, M., 2008. Dubai-a star in the East: A case study in strategic destination branding. Journal of Place Management and Development, 1(1), pp.62-91.