Table of Contents

Why productivity growth has slowed down in many rich countries over the last decade?

This paper examines why the productivity growth has been slowing in many rich countries over the last decade. Productivity is the measure of the efficiency of workers as the proportion of the average output of the production process to the resources consumed during the production over a specific period (OECD, 2015). Productivity is very crucial because it determines the cost efficiency of production hence economic growth. Higher productivity leads to better standards of living since the increase in real income of the citizens increases their purchasing power, better education, more leisure time and other social amenities. At the firm level productivity leads to the profitability of the firm while at national level productivity is results in the growth of domestic product (GDP). Growth in productivity contributes to economic growth and helps the country to handle other fiscal challenges (Dervis & Qureshi, 2016). However, despite the contribution of immigrants to the growth in the labour force the productivity could have been suppressed by other factors such as inadequate skills and knowledge, low capital investment as well as low weak demand.

Growth in productivity is attributed to increasing efficiency of production due to increased technological innovations and capital investments (Schulze, 2014, P. 380). There are many resources or input used in the production process such as labour and capital (Heijdra, 2017). The growth in labour productivity is an indication of skills and knowledge of workers which contributes to increasing labour efficiency. Productivity growth increases average income per person. Consequently, there is an increase in disposable income which is a great stimulant of economic growth (Dervis & Qureshi, 2016). In developed countries, labour is one of the essential factors of production and labour intensive industries seems to experience growth challenges because adding more labour increases the overall cost of production and reduce profitability.

The growth in productivity in developed countries has been slowing over the last decade. Countries like Europe, Germany and the United States have experienced sluggish growth in productivity. The decline in productivity growth can be attributed to several factors. The ageing working population and low capital investments due to aftereffects of financial could be some of the causes of declining productivity (OECD, 2015). Capital and labour are the two main components factors which determine productivity. However, technology, skills and knowledge of workers, as well as government policies, also affect productivity growth (Dervis & Qureshi, 2016). Solow-Swan model has been used to analyse the factors responsible for declining productivity growth. The model assumes that capital and labour are the two factors of production.

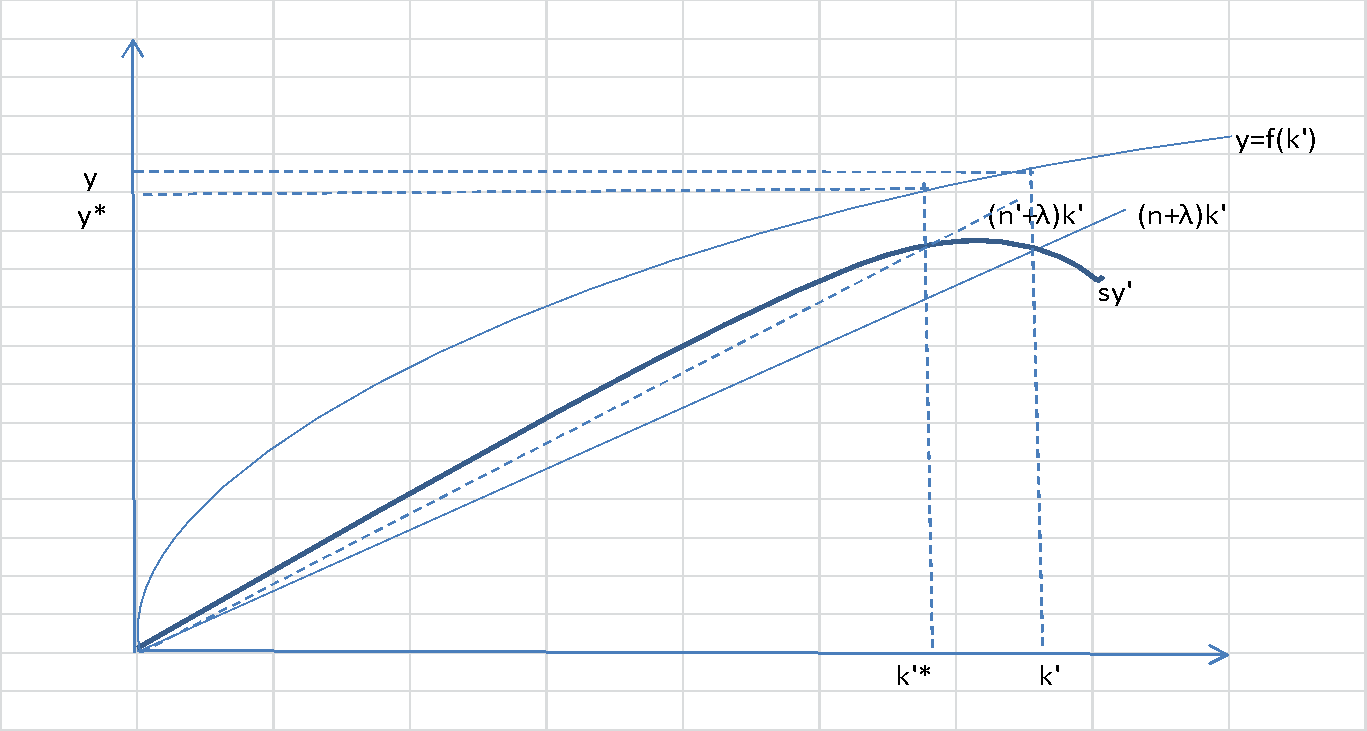

Figure1. Solow-Swan Model

Source, (Heijdra, 2017).

The Solow-Swan Model achieves a steady state of growth when k=0, therefore the steady state is achieved at sf (k) = (n+λ) K. The equation y=f(k). y is the output per worker while .k= Capital per worker.

The model assumes that income or output (Y) is a function of two resources which are labour (L) and capital (K), such that Y = F(K, L). The production function expressed as y = f(K) while the saving per worker, sy = sf(K). Therefore, a certain investment is required to achieve specific capital per worker (k) depending on the growth of population and rate of capital depreciation (λ) (Novales, Fernández & Ruiz, 2014, p. 105). Also, assuming a constant growth of population (n), the required capital investment per worker = (n +λ) k. The excess of capital per worker over the needed investment to sustain capital per worker denotes the savings per worker sy.

The output per worker (y-axis) denotes the capital-labour ratio. The production function {y’=f(k)} illustrates that the labour productivity per worker increases at diminishing rate k’ as stated by the law of diminishing returns (Heijdra, 2017). Available capital influences the output per worker. Higher labour will also require more capital to meet the investment requirements (n+λ)k’.

The Solow-Swan model is based on various assumptions. For instance, capital and labour resources are substitutable. This implies if a country has more of either labour or capital over the other the productivity will remain at steady state because the two will supplement each other. Therefore, productivity growth in developed countries could have slowed because of low capital investment since the occurrence of the financial crisis and due to the scarcity of labour (Dervis & Qureshi, 2016). Also, productivity per worker can be increased by increasing rate of savings or decreasing population growth rate. The decline in investment will cause the savings per worker (sy) shifts from (n+λ) k’ to (n’+λ)k’. The productivity per worker stabilises at y* as the capital reduces to k*. Therefore, low capital investment in developed countries over the last decade could have contributed decline in productivity growth due to the low rate of savings. Increase in the factor of production while the other remains constant will result in an increase of output at decreasing rate hence slowing productivity growth.

Technological advancement also influences the productivity growth of workers. Growth in technology leads to higher efficiency of labour and utilisation of capital (Schulze, 2014). The production function y = f(k’) slopes to the right due to diminishing returns to capital. Though there has been growth in technology over the last decade, there has not been an efficient method of measuring the effects of technology on productivity. The implication of Solow-Swan model is that countries with higher capital investment will experience slow productivity growth than countries will low capital investment due to diminishing returns to capital (Heijdra, 2017). Therefore, developed countries which have huge capital investments continue to experience slow productivity growth.

Furthermore, the model suggests that if the capital increases while labour remains constant the productivity growth will remain at steady state. The steady-state y = (n+λ)k’ involves the component of capital depreciation. This implies if capital alone is growing while labour remains constant a proportion of that capital is lost due to depreciation. Therefore, the output will remain steady. In developed countries labour input is almost steady (Dervis & Qureshi, 2016). Since capital investment has also been low owing to the aftereffects of the financial crisis, this could have contributed to slow growth in productivity.

Other factors include government policies. The government policies will influence the productivity of labour in many ways. Taxation policies will affect the rate of savings hence productivity growth. Labour laws and employment policies will also influence the utilization of labour hence influence productivity (Dervis & Qureshi, 2016). Also, government policies may promote research and technology which could lead to higher efficiency of labour hence higher productivity. In developed countries such as the UK and U.S. government policies are efficient and support productivity growth (Schulze, 2014). However, due to other factors, the growth has been slowing over the last decade. Therefore, a combination of factors must be in place to support higher productivity.

In conclusion, the slowing productivity growth in developed countries over the last decade could have been caused by various factors. Based on the Solow-Swan model capital and labour are the two important inputs influencing output. Developed countries have experienced slowing productivity growth over the last decade due to various reasons. The level of capital and labour inputs will determine productivity. Although the capital investment is huge depreciation on capital reduces the effective value of capital. Also, labour has grown at a nearly constant rate, and savings have decreased due to hard economic challenges contributed to the financial crisis. The government policies also influence productivity growth. Therefore, favourable factors supporting productivity growth must be in place to support higher productivity growth.

- Dervis, K. & Qureshi, 2016, The Productivity Slump – Fact or Fiction: The Measurement Debate, Global Economy and Development at Brookings, Retrieved from; https://www.brookings.edu/wp-content/uploads/2016/08/productivity-measurement-debate.pdf Accessed 10 March 2018.

- Heijdra, B.J., 2017, Foundations of Modern Macroeconomics,3rd Ed. Oxford University Press, UK, pp. 1-1040.

- Novales, A., Fernández, E. & Ruiz, J. 2014, Economic Growth: Theory and Numerical Solution Methods, 2nd Ed. Springer, London, pp. 1-558

- OECD, 2015, T`he future of Productivity, Retrieved from, https://www.oecd.org/eco/growth/OECD-2015-The-future-of-productivity-book.pdf Accessed 9 March 2018.

- Schulze, M. (Ed) 2014, Western Europe: Economic and Social Change Since 1945, Routledge; London & New York, 1-424.