Table of Contents

EXECUTIVE SUMMARY

Procter and Gamble is one of the most popular companies in the contemporary global consumer goods industry. A fact sheet of the operations of the company has been provided in the current paper. The Fact sheet contains the details of its achievements in the global market. It is followed by the mission, vision, values and goals of Procter and Gamble. The paper also analyses the strategies and objectives of the organization. The organizational strategies and objectives of Procter and Gamble have been summarized with the help of a balanced score card. The types of the strategies and the competitive advantage have been identified along with an analysis of the organizational size and structure. The resource base of the company has been assessed with reference to human resource, financial resource, technology resources and physical assets. The strengths and weaknesses of the company have been identified with reference to its leadership, management and governance while assessing the learning and change of the firm. Necessary recommendations have been provided to the company for the betterment of the firm in the future.

INTRODUCTION

Procter and Gamble is a multinational company, originating in America, operating in the consumer goods industry. Primarily, the company was a specialist in manufacturing cleaning agents and personal care hygienic products. Later, the product portfolio of the company expanded to food, beverages and snacks (PG, 2018b). Having started in Ohio, Procter and Gamble currently operates in nearly eighty countries, which include Asian countries (regional headquarter at Singapore), Central and Eastern Europe, Middle East and African countries (regional headquarter at Switzerland), Latin American countries (regional headquarter at Panama City), North American countries (such as Canada, the United States and Puerto Rico with regional headquarter at Ohio) and Western European countries (regional headquarter at Switzerland) (PG, 2018a). The company operates with the mission of providing high quality branded products to the global consumers while improving their standard of living (PG, 2018c).

In the upcoming sections, the adherence to the company’s mission, vision and values have been analyzed with reference to its organizational strategy and objectives, structure, leadership, governance and management systems. In the process, the competitive advantage of the firm has been identified while identifying the critical resources and strengths and weaknesses of Procter and Gamble. The learning and change undergone by the company from its early years of operation till the contemporary years have also been highlighted.

FACT SHEET

Procter and Gamble was started in Cincinnati, Ohio, by William Procter and James Gamble in 1837, to manufacture and sell candles and soap (History, 2018). After running the company as a partnership for 53 years, Procter and Gamble’s partnership transitioned to a publically traded company, listed on the New York Stock Exchange as P&G in 1890 (History, 2018).

David S. Taylor is Chairman of the Board, President, and Chief Executive Officer, and oversees 110,000 employees. The Procter and Gamble Company specializes in household and personal care products, and their purpose is a growth strategy of improving more consumers’ lives in a meaningful way (Fiscal, 2018). Procter and Gamble now focusses on roughly 70 brands and operates through the following segments: beauty, hair, and personal grooming; health care; fabric care and home care: and baby, feminine, and family care products (Fernando, 2017).

Procter and Gamble is the leading maker of household goods in the United States and dominates as a global organization with a market cap of 228.1 billion (Gara, 2017). Procter and Gamble have 21 brands with annual sales of $1 billion to about $10 billion, and 11 brands with sales of $500 million to $1billion, many of those with billion-dollar potential (Fernando, 2017). Procter and Gamble operate in over 180 countries, its fiscal year 2017 net sales were $65.1Billion (Gara, 2017).

Procter and Gamble have provided well-known, branded products for over 175 years, and has evolved to surpass many competitors of its kind through adapting to consumer’s needs through ingenuity and innovation. Their products are known globally, and currently rank number 14 in market value, 20 in profits, and 15 of the “Just 100: America’s Best Corporate Citizens” by Forbes (Gara, 2017).

Mission, Vision, Values, and Goals

Mission

Procter and Gamble is the largest consumer-goods retailer in the United States, and second largest in the world, rivaled by Nestle globally and Unilever domestically (Nicolaou, 2018). Procter and Gamble’s mission statement is “We will provide branded products and services of superior quality and value that improve the lives of the world’s consumers. As a result, consumers will reward us with leadership, sales profit, and value creation, allowing our people, our shareholders, and the communities in which we live and work to prosper” (Purpose, 2018).

Top innovative brands are the core of Procter and Gamble’s mission; it differentiates their brands against competitors, the key to consumer loyalty. For 175 years, Procter and Gamble’s purpose has been to transcend the consumer-goods industry and surpass the competition. Consequently, in the past two years, sales growth slowed, contributing to lost market share, in four out of five main product categories, totaling an eight-percent loss in sales growth (Kalogeropoulos, 2016). Procter and Gamble now suffer from Mission Creep due to their large size, and misguided direction of the course of growth. To recover from mission creep, Procter and Gamble divested expendable brands, and their board of directors issued a statement that addresses implementing a transformation plan to put the company back on track to adhere to its mission statement (P&G Details, 2018).

Vision

Procter and Gamble’s research and development division consists of eight thousand employees with an annual budget of two billion (External, 2017). In contrast, Johnson and Johnson, a rival competitor, spends nine billion a year on research and development (Kalogeropoulos, 16). Procter and Gamble’s vision statement is “Be, and be recognized as, the best consumer products and services company in the world” (Purpose, 2018). Procter and Gamble is falling short on its vision as of late; this notion is shared by Nelson Peltz, a billionaire, activist, and investor who recently achieved a narrow proxy board victory for a board seat in Nov 2017 (Nicolaou, 2018). Nelson Peltz is outspoken on Procter and Gamble’s slump, and argues for a strategy shift, chiefly because Procter and Gamble’s super brands lost market share for almost ten years running (Nicolaou, 2018).

As a result of Nelson Peltz vocalness, he nearly beat Joseph Jimenez as director of the board due to his favored assessment of Procter and Gamble (Orol, 2017). The Trian Fund management partner Josh Frank, a senior analyst and co-author of a 93-page white paper on Procter and Gamble, made similar remarks on CNBC, saying “They have not created a meaningful new brand since Swiffer, almost 20 years ago,” Frank said. “And R&D behind existing brands has been incremental, not game-changing” (Orol, 2017).

Procter and Gamble’s current leadership is not adhering to its current mission and vision statements. However, Procter and Gamble recognized that it was too bloated, and sold off many brands to focus on its remaining brands. Now their attention needs to be on how to structure research and development better to improve products and become more profitable with innovative breakthroughs.

Values

Procter and Gamble value statement is as follows: “Procter and Gamble is the people and the values by which we live. We contract and recruit the finest people in the world. We build our organization from within, promoting and rewarding people without regard to any difference unrelated to performance. We act on the conviction that the men and women of Procter and Gamble will always be our most important assets”(Purpose, 2018). The values of Procter and Gamble are consistent with its actions as far as recruitment, promoting from within, recognition, and diversity. Based on their reputation, and leadership, Forbes ranked Procter and Gamble #63 on the list of World’s Most Reputable Companies; Fortune ranked Procter and Gamble #17 among the “World’s Most Admired Companies” and 1 in their industry (Soaps and Cosmetics), Barron’s ranked Procter and Gamble # 31 on the ‘World’s Most Respected Companies List”; and in 2015, Glassdoor ranked Procter and Gamble #11 of Employee Choice Awards for Best Place to Work (External, 2017).

Procter and Gamble’s commitment to its values is overwhelmingly documented by various external sources. Diversity has ranked Procter and Gamble #10 among the top companies for diversity, and the company is ranked #1 by the National Association of Female Executives (External, 2017). It is undeniable that Procter and Gamble “Values” its employees, and values are in alignment with its Mission and Vision.

Goals

Procter and Gamble’s goal is “meeting the needs of consumers better than the best competitors to deliver winning total share return” (Purpose, 2018). Procter and Gamble is going through a transformation said to yield positive results for shareholders, outlined in their letter to the board. (P&G Details, 2018). The plan addresses increased productivity, cost savings, brand restructuring, increased innovation, and organizational leadership changes, all of which are needed to regain ground and make good on its mission and vision.

Procter and Gamble’s letter to shareholders highlights that the board and management recognize the need for transformation and repositioning to meet the constant changes in the consumer, retail, and marketing environments (P&G Details, 2018). Procter and Gamble will be successful in adhering to its Mission and Vision Statement if corrective actions are implemented.

Organizational Strategy and Objectives

Procter and Gamble shifted to a Global Strategy in 2001, where it expanded across international markets in hopes to gain international traction, using a broad-based approach (Warren, 2012). However, Procter and Gamble’s global direction became targeted, thus enhancing market share in targeted geographies (How Procter, 2018). As a result, over 60 percent of Procter and Gamble’s annual sales are from International markets, an increase of 20 percent since 2001 (How Procter, 2018).

Procter and Gamble’s organizational structure is comprised of Global Business Units, Selling and Market Operations, Global Business Service and Corporate Functions (Corporate, 2018). The Global Business Units operate where Procter and Gamble have leading market positions and are responsible for developing each categories brand strategy, marketing, new products, upgrades, and innovation (Corporate, 2018). The flexibility of the Global Business Units provides each category president with autonomy for combining global scale benefit with a local focus on retailers and the individual customer.

Procter and Gamble implemented a grouping of its Global Business Units into industry-based sectors on 1 July 2013 (P&G Reorganizes, 2018). A.G. Lafley, the former Chief Executive Officer that pioneered the Global Business Unit change, said, “This sector organization and leadership team will help us operate more effectively and efficiently.” Mr. Lafley also said, “Sectors will drive technical, commercial, financial, and organizational synergies to improve results” (P&G Reorganizes, 2018). The Global Business Units categories include Baby Care, Fabric Care, Family Care, Feminine Care, Grooming, Hair Care, Home Care, Oral Care, Personal Health Care, and Skin and Personal Care (Corporate, 2018).

Procter and Gamble’s Selling and Market Operations are broken out in six regions: Asia Pacific, Europe, Greater China, India, the Middle East and Africa, Latin America, and North America (How Procter, 2018). The Selling and Market Operations develop and execute go-to-market plans at the local level (Vijayraghavan & Malviya, 2014). The Selling and Market Operation and Global Business Units allowed Procter and Gamble to the company become leaner, reduce cost, reduced management layers, and increased strategy execution (Vijayraghavan & Malviya, 2014).

Procter and Gamble’s leaner business concept and shedding of brands was a result of its cost-cutting plan, which saved the company 10 billion dollars (Terlep, 2017). The success of Procter and Gamble’s major cost-savings initiative was short-lived, and currently, the company remains to stagnate, to the point where the current Chief Executive Officer introduced another 10-billion-dollar cost-savings plan (Terlep, 2017).

Procter and Gamble current business strategy and structure is under attack by major shareholders, primarily Nelson Peltz, that recently won a very narrow decision for a board seat (Terlep, 2017). Procter and Gamble’s sales growth had slowed since the fiscal year 2013 when sales reached 74 Billion, the company’s sales reported in subsequent years were less, and only 64 billion in the fiscal year 2017 (Stevens, 2017). To expound on Procter and Gamble’s puzzling operating performance, especially, in the United States, Chief Finical Officer, Jon Moeller, is quoted saying during a conference call with investors “We’ve been unable to put our finger on why this has been,” (Terlep, 2017).

Procter and Gambles two remaining components of their corporate structure are Global Business Services and Corporate function (Corporate, 2018). The Global Business Service Unit supports the Global Business Units and employees in all facets of day to day operations such as payroll, information technology, business administration, and facilities management (Corporate, 2018). Procter and Gamble’s Corporate Function provides company-level strategy, human resources, tax, portfolio analysis, and legal services (Corporate, 2018).

Balanced Scorecard

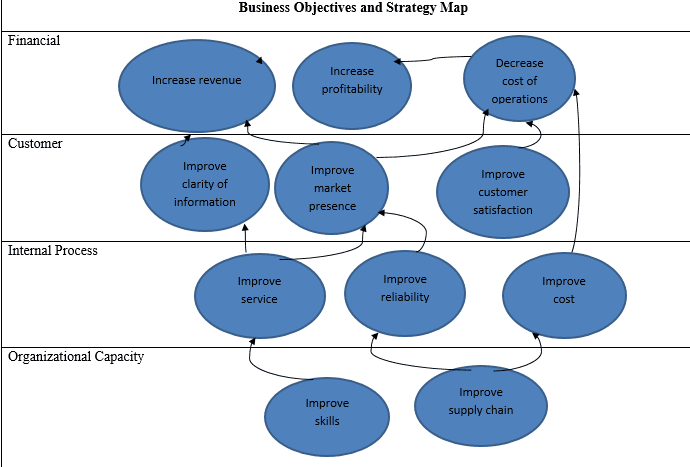

The following figure provides the balanced scorecard of Procter and Gamble on the basis of its objectives and strategies:

Figure 1: Balanced Scorecard of Procter and Gamble

| Strategic Priority | Supplier satisfaction | Customer satisfaction | Brand awareness |

| Strategic Result | Strong supply chain that can meet needs and demands of the company and the suppliers | High quality product and service that can satisfy the needs and requirements of customers | Increase in sales and market share in the global consumer goods industry |

| Business Objectives and Strategy Map |

| Financial |

| Customer |

| Internal Process |

| Organizational Capacity |

| Domain | Business Objectives | Measures | Targets (per year) | Initiatives |

| Financial |

|

|

|

|

| Customer |

|

|

|

|

| Internal Process |

|

|

|

|

| Organizational Capacity |

|

|

|

|

Strategy Types and Competitive Advantage

Procter and Gamble’s organization strategy is fundamentally backed by has six core competencies: consumer understanding, innovation, branding, go-to-market capabilities, and scale and productivity (Our Core, 2018). Moreover, the company is still the leader in the United States consumer goods industry but must improve on its core competencies to continue further growth.

Procter and Gamble’s Consumer Understanding was recently challenged by Nelson Peltz of Trian Partners, in the firm’s 90-page white paper released in September of 2017 (Danziger, 2017). Mr. Peltz argues that Procter and Gamble’s consumer preference is fragmented, and consumers used to trust big brands, but now, many millennials seek out purpose led brands (Danziger, 2017). A business writer for the Wall Street Journal, Stephen Wilmot says “P&G risks giving the impression that it is losing touch with the U.S. consumer culture” (Wilmot, 2017).

Millennials are said to disrupt family-oriented businesses such as Procter and Gamble, and a culture of change is required for Procter and Gamble to understand all consumers (Larsen, 2017). Millennials are projected to make up 50 percent of the entire United States workforce in 4 years (Larsen, 2017). Procter and Gamble will have to capture the millennial generation to stay competitive and to maintain their consumer understanding.

Procter and Gamble once was an industry leader in innovation, and their research and development were the backbone of its growth (Brown, & Anthony, 2011). It was a time when Procter and Gamble spent 50 percent more on Research and Development than its closest competitors, and more than most other competitors combined (Brown, & Anthony, 2011).

In contrast to Procter and Gamble’s innovative glory years, the company only created two new brands with sales that topped one billion per year this century (Reingold, 2016). Procter and Gamble’s innovation slump has invited critiques that use the company’s innovation stagnation as leverage to bring about board membership and organizational changes (Wilmot, 2017). Josh Franks, a senior partner of Trian Fund Management argues that Procter and Gamble should reduce its Global Business Units to reduce layers and implement a Research and Development at the Business Unit Level, in addition to a central Research and Development above the Global Business Units (Orol, 2017).

Outside of the internal threats, Procter and Gamble is still accountable to its shareholders and has a plan to use the money from its latest 10-billion-dollar cost saving initiative to increase the current research and development budget, an attempt to bring about organic sales increases (Nicolaou, 2018).

Procter and Gamble have 65 brands, 21 of those brands produce an annual sales range between one to ten billion dollars, and 11 brands sales vary between 500 million to one billion dollars (Our Core, 2018). Procter and Gamble Pampers, Tide, and Gillet brands are its most significant, the pamper brand leads company sales, responsible for 9 billion of Procter and Gamble’s yearly global sales (Kalogeropoulos, 2017).

Procter and Gamble’s Fabric sector is the largest, claiming 32 percent of total sales, Tide leads sales of the fabric sector (Kalogeropoulos, 2017). Procter and Gamble’s Chief Executive Officer said, “Fabric care results demonstrate what is possible when we deliver superior value from a best-in-class performance at a modest price premium,” (Kalogeropoulos, 2017). Procter and Gamble increased advertising, focusing on Tide products, such as Tide pods formula’s and Tide Pure Clean, to address weaknesses in their largest sectors leading brand (Kalogeropoulos, 2017).

Procter and Gamble’s Gillet brand was a significant leader in revenue but has lost market share to private label brands, which use a subscription-based approach (Kalogeropoulos, 2017). Over the course of five years, Procter and Gamble’s North American market share decreased from 71 percent to 54 percent (Hoium, 2018). As a result, Gillet has a shave club, more affordable razors, and Gillet razors are going to be up to 20 percent cheaper (Wahba, 2017). Procter and Gamble’s Chief Financial Officer Jon Moeller says, “We are making smart adjustments across the line-up to restore a historical model and proven strategy” in response to the Gillette brand (Wahba, 2017).

60 percent of Procter and Gamble revenue is generated from international sales; however, they still have lots of room for growth in developing economies (Tenebruso, 2017). Procter and Gamble should further increase targeting, and go-to-market-capabilities, to enhance increased opportunities in emerging markets because the growth of sales depends on it (Tenebruso, 2017). Additionally, Procter and Gamble have to find a way to regain appeal in the North American market, because it has the resources and capabilities to achieve success with applying the right strategy (Kalogeropoulos, 2017).

Finally, Procter and Gamble must capitalize on its scale and productivity as an advantage to increase its profitability. Procter and Gamble diversity of their business portfolio allows the company to leverage each of their respective segments. For example, their Health and Beauty segments purchasing pools created by Household business, like diapers, laundry, and paper products (Designed to, 2018). In turn, enables other segments to purchase packing materials and basic commodities at lower cost, than direct competitors (Designed to, 2018). This leveraging allows segments such as Household Care benefit from economies of scale created by the massive advertising budgets supporting our Health and Beauty Care businesses (Designed to, 2018).

We can do it today.

Organizational Size and Structure

Organizational Size

Procter and Gamble employees 110, 000 worldwide, operates in 80 countries, and their brands are used in at least 180 countries (Corporate, 2018). According to statista, Procter and Gamble came in at number three in Brand value of the leading personal care brands, and number one in sales of the leading household/personal care companies worldwide in 2016 (Sales of the, 2018). Procter and Gamble’s global operations are broken into five regions that include, North America, Western Europe, Asia, Latin America, and Central and Eastern Europe, Middle East and Africa (Where we, 2018). Procter and Gamble’s North American region headquarters is in Cincinnati, Ohio, and makes up 40 percent of company sales (Where we, 2018). It consists of 35 manufacturing plants, throughout Canada, Puerto Rico, and the United States (Where we, 2018).

Procter and Gamble’s Western Europe region’s headquarters is in Geneva, Switzerland has 35 manufacturing plants, and employees 3,000 scientists, working out of nine innovation centers throughout Western Europe (Where we, 2018). The Western Europe region represents 20 percent of Procter and Gamble’s total business, and market 100 brands (Where we, 2018).

Procter and Gamble’s Asia region headquarters is in Singapore, and employees 800 scientists in four technical centers throughout the region (Where we, 2018). The Asia region is significant to Procter and Gamble because it is home to 3 billion consumers (Where we, 2018).

Procter and Gamble’s Latin American region headquarters is in Panama City, has 19 manufacturing sites, 12 distribution centers, and employees people throughout 14 countries (Where we, 2018). Procter and Gamble’s Central and Eastern Europe, Middle East and Africa region is its most extensive, and headquarters is in Geneva, Switzerland (Where we, 2018).

Procter and Gamble’s most significant segment of net sales was its Fabric and Homecare segment (Where we, 2018). This segment earned 32 percent of total net sales (Where we, 2018). The Baby, Feminine Care, and Family Care segment received 28 percent of Procter and Gamble’s total net sales, followed by the Healthcare segment, earning 12 percent of net sales, and the Grooming segment 2017 net sales were 10 percent (Where we, 2018). Procter and Gamble’s sales amounted to 76 billion in revenue (Sales of the, 2018).

Procter and Gamble may not have a new billion-dollar brand, however, in 2007, its first service, Mr. Clean Carwash was unveiled in Ohio (Heritage, 2018). Mr. Clean success led to the second addition of its services sector, called Tide Dry Cleaners (Heritage, 2018). Tide Dry cleaners opened in 2008, generating 2.5 million dollars in sales in two years (Heritage, 2018).

Organizational Structure

Procter and Gamble’s organizational structure can be a little challenging to understand at a glance because several senior leaders where multiple hats, however, the upper hierarchy structure is simple enough to follow. The 10 Global Business Units Presidents fall under four Group Presidents. Group categories are as follows: Global Grooming; Global Family Care; Global Healthcare; Global Fabric, Home Care, Global Baby, and Feminine Care (Leadership team, 2018).

Procter and Gamble’s Selling and Market Operations President is the North American Regional President and Group President for all Procter and Gamble’s regions (Leadership team, 2018). Lastly, Procter and Gamble’s Chief Executive Officer is the company’s President, and Chairmen of the board, all Group Presidents report directly to him (Leadership team, 2018).

In closing, Procter and Gamble’s structure and scale support its growth and business strength. Although Research and Development is an area of concern (Danziger, 2017). Procter and Gamble is losing to retailers they supply (Danziger, 2017). Companies such as Walmart, Costco, Sam’s Club, and Target are purchasing less because they have maneuvered into Procter and Gamble’s territories – selling generic versions of household items, such as beauty, fabric, and baby products, at a lower cost (Danziger, 2017). Procter and Gamble still maintain loyalty from baby boomers, and consumers that prefer their brands, however, lower-end consumers, and millennials purchasing power are too significant to ignore (Danziger, 2017). If Procter and Gamble can make necessary adjustments to its innovation, the consumer industry giant will continue to triumph.

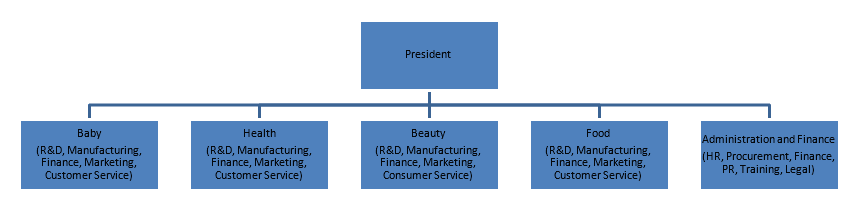

The following figure represents the organizational structure of Procter and Gamble:

Figure 2: Organizational Structure

(Source: Author’s Creation)

Critical Resources

Human Resources

An organization’s Human Resources (HR) is vital to its success, because HR is tasked with recruiting, compensation, training and development, increasing effectiveness within the organization, and Procter and Gamble employees 110,000 people, in over 100 countries, and are charged with the focus on productivity by revamping sales over the size of the workforce, and employee engagement (P&G).

Research from Universum Global surveyed college students worldwide, and Procter and Gamble was ranked number 13 for top 50 dream job for students (Smith & Cain, 2016). Procter and Gamble is estimated to receive upwards of one million applications for employment a year, for less than 5,000 openings (Filipkowski & Donlon, 2014).

Procter and Gamble is well known for developing employees from within, 95 percent of their hire is at entry level, external leadership accession is to fill individual cases (Gibby, 2013). To further express Procter and Gamble’s commitment to hiring talent, former Chief Executive Officer, Bob McDonald says, “I personally am on a college campus somewhere in the world every three months” (Filipkowski & Donlon, 2014).

Procter and Gamble switch to analytics-posed challenges, such as multiple work-specific processes existing with no integration, all Human Resource data links to a person, no position database, and talent management data loosely integrated (Gibby, 2013). Therefore, the employee survey program was the inception of Human Resource analytics (Gibby, 2013). The survey program evolved into creating automated stat analysis, using eight-plus years of data points, structural equator models, and employer choice models (Gibby, 2013). It focused on three outcomes: performance, retention, and creation of an inspiring place to work (Gibby, 2013).

Procter and Gamble teamed up with Accenture, a global management technology consulting service, to brand a talent by design solution program (Procter & Gamble, 2018). Through the collaboration, 92 percent of users said employees’ career and performance management was simplified (Procter & Gamble, 2018). Additionally, Procter and Gamble had better visibility of its talent pipeline and possible talent concerns, which contributed to an improved workforce planning process (Procter & Gamble, 2018).

Senior Managers at Procter and Gamble are graded on their ability to develop new hires; moreover, formal and informal training is a mandatory function of the company’s training (Filipkowski & Donlon, 2014). Procter and Gamble focus on developing their talent into the next leadership role by guiding them to be ready for the next step in three to five years (Filipkowski & Donlon, 2014). Hajime Tamaoki, Project Lead and Director, Human Resources Solutions, and Services at Procter and Gamble says “Procter and Gamble have increased visibility into exactly who our high performers are throughout our organization. This will visibility will enable us to make informed workforce decisions based on the performance level, including the talent and skills of the individual rather than just by role” (Filipkowski & Donlon, 2014).

Procter and Gamble is recognized as the best for leadership development, by Chief Executive Magazine for several years running (Filipkowski & Donlon, 2014). Their formal training, known as leadership development model is to coach their employees enable success and focuses the effort to work towards Procter and Gamble’s Mission, Vision, and Principles (P&G). Finally, the Procter and Gamble approach is to develop their employees from within, growing them to provide the company with vast experience and corporate knowledge unmatched across the industry. The average Procter and Gamble president has almost 30 years of experience across several business functions, and regions (P&G Recognized, 2018).

Financial Resource

Procter and Gamble is publicly traded on the New York Stock Exchange, revenue is 17.38 billion, net income 2.5billion, net profit margin 14.34, and has a market cap of 213.74 billion (The Procter & Gamble, 2018). Procter and Gamble use called System, Applications, and Products (SAP), also known as the Enterprise Resource Planning (ERP) solutions for its finance management(). Procter and Gamble’s income is used to maintain its dominance in the consumer goods industry, (After Major, 2018). An average of 7 billion dollars was spent on advertising over the past three years (After Major, 2018). Additionally, Procter and Gamble’s is one of the leading companies for generating money, reaping 90 percent of profits into available cash, that cash is used to reinvest in the business (Kalogeropoulos, 2017). Procter and Gamble recent cost savings initiative, coupled with its increased efficiency, set them apart from its industry peers in regards to profitability comparison (Kalogeropoulos, 2017).

Procter and Gamble consumer goods global dominance is the reason why it is a highly sought after company for investments. It is estimated more than 40 percent of the company stock is held by investors, and institutional holdings (Procter and Gamble, 2018). Earnings for Procter and Gamble are expected to raise increase over the next five years with modest gains (Earning growth, 2018).

Technology Resources

Procter and Gamble rely on data to execute its mission, vision, and goals. The collection of data drives business, efficiency, and saves time and money. Procter and Gamble is a massive company, with locations, people, and resources spread across the globe – depending merely on emails, phone conferences, and SharePoint would not be enough for the company to prosper. Simply put, Procter and Gamble would not function without the use of adequate technology.

Procter and Gamble use analytics supported by a highly functional advanced operating system, and contractors that provide, cloud, and sophisticated remote networking services (Chui & Fleming, 2018). Procter and Gamble’s advanced analytics offers a set of standard reports from defined Human Resource metrics, and key performance indicators (Gibby, 2013). The move toward analytics integrated stand-alone systems developed operational and strategic workforce planning, implemented a cohesive dashboard system, and provided autonomation for scale and efficiency (Gibby, 2013).

Communication is vital, which is why the company worked with external partners to institutionalize a data visualization software (Davenport, 2013). Procter and Gamble’s management team can utilize the software that was pushed to over 50,000 computers to access the coined term “Decision Cockpit” (Davenport, 2013). The technology innovation at Procter and Gamble also brought about what is called “Business Sphere,” located at 50 locations, where decisions can be made by management as a group (Davenport, 2013). These rooms are equipped with embedded analytics that can activate a facet of functions, such as what the company calls “heatmap” (Davenport, 2013). The heatmap provides a picture of where all the Procter and Gamble’s products stand in their respective market (Davenport, 2013). The advanced software used provides managers the flexibility to see business dynamics, and make appropriate responses (Davenport, 2013). To best sum it up, Procter and Gamble’s Chief Information Officer said, “getting beyond the what to the why and the how” (Davenport, 2013).

Autonomation – Core Competency

Procter and Gamble developed a system that broadcasted to any requestor the movement of all merchandise as it progressed through the manufacturing pipeline at any plant (Chui & Fleming, 2018). Procter and Gambles cloud computing usage, allowed it to collect, transfer, and load movement from its warehouses, additionally, their digitization married the operation and financial system, linking the two, enabling the displays of the cost of the product as it goes through production (Chui & Fleming, 2018). The use of digitization also empowered an operational program named control tower, which provides real-time footage, of all transportation of goods on demand (Chui & Fleming, 2018).

Procter and Gamble learned that when it conducted business with retailers through human interaction, there were upwards of 70 percent order errors (Chui & Fleming, 2018). Autonomation cut the error rate to nearly zero through the use of a system named Global Data Synchronization Network (GDSN), it connected the retailers digitally, allowing commerce exchange without human interaction, saving time, and millions of dollars (Chui & Fleming, 2018). Lastly, Procter and Gamble developed a mobile app that enabled retailers to place orders wirelessly, benefiting retailers in developing countries (Chui & Fleming, 2018).

Procter and Gamble’s has a massive footprint in their industry and need to know instant information about anything concerning commerce. Therefore, through digitization, mechanisms were implemented to signal Procter and Gamble if any tolerance measures swayed beyond programmed levels, equipping the company with immediate response measures (Chui & Fleming, 2018). Procter and Gamble were able to synchronize operations with a systematic approach, enhancing the speed and agility to respond in the marketplace instantly, creating a competitive advantage. Hence, the systematic operational approach of the company which in turn enhances automation of the production process of the firm has developed as the core competency of Procter and Gamble. Although Procter and Gamble’s technological advancements are yielding remarkable success, the company is continuously looking for improvements to push boundaries.

Physical Assets

Procter & Gamble (P&G) is a multinational consumer products corporation. For running the business operations effectively around the world, the company significantly emphasizes on physical assets apart from other intangible assets. The investment is made on buildings so that different operational activities can be carried out in order to generate productive value. Furthermore, machinery and equipment is required by the company as it supports in increasing the operational efficiency and making the products that can be timely supplied in the market. Other physical assets that are required by the company is furniture, vehicles, and computer equipment for managing the database of the business and clients. On the other hand, it can be pointed out that land is needed for setting the infrastructure to carry out the business activities in the markets where the firm operates. It can be discussed that having different physical assets in the organization largely assists in supporting the complex business operations so that expected production can be done for fulfilling the need and demand of the customers. It is also crucial for P&G to arrange required physical assets in all the markets in order to maintain the effective flow of business activities. It can be further discussed that cash is one of the crucial physical assets on which the firm largely focuses as it helps in buying other valuable assets and paying of the short-term and long-term liabilities. Having physical assets in the organization supports in reducing the risk by paying for losses which may arise in future.

Leadership, Governance and Management

The leadership style in P&G is that of participatory, empowerment and delegation. This supports in engaging the employees in crucial decision making process and allowing staff to use their knowledge and expertise that can help the organization to attain maximum results. It has been identified that the company offers a wealth of technical, functional and leadership skills training. These are done to enhance the creative and innovative side of employees that can assist them to perform tasks with minimum mistakes. The leaders of P&G provide opportunity and flexibility to staff to carry out their respective tasks, which significantly contributes to the firm’s MGVOs and its reputation.

The governance of P&G is comprised of policies, laws, procedures and practices that safeguard the well-being of P&G. It enables the shareholders, management and Board of Directors to make sure that all external and internal stockholders are secured against managers that acts only in their best interest. P&G conducts its operation with integrity at all levels and in all nations, both externally and internally. The corporate structure of P&G consists Selling and Market Operations, Global Business Units and Services and Corporate Functions. This helps in tapping global advantages. It can also be mentioned that governance structure of the firm is formally documented that provides assurance of independent and expert oversight and review of key organizational decisions and policies.

P&G significantly applies management control system for efficiently organizing resources and directing activities for attaining organizational goals and objectives. It can be stated that the management control enables the firm to effectively focus on developing new products, maintaining cost level down and increasing market share. The management team regularly monitors the flow of work and involvement of employees in carrying out assigned tasks. This contributes in decreasing the chances of errors. Furthermore, the management makes sure that the attitude of workers align with the strategic direction and best interests of the organization. It has been identified that the firm uses automated solution that enables it to efficiently move its mix of pallet-based goods via an augmented complex supply chain. This supports in controlling the movement of products from one location to another.

Strength and Weakness

Strength: P&G has an excellent R&D because of which it has successfully innovated and brought number of consumer goods in markets. Moreover, due to excellent marketing and advertising, brands of the company have a high recall value. Brands have also contributed as sponsors in popular entertainment and sporting events. P&G has strong market positioning because of superior distribution channels and making products available through supermarkets, online, etc.

Weakness: P&G does not produce and provide any private label goods for the retail consumers. It has been also determined that fake products are traded under the name of P&G brands. It is difficult for the company to track and control the sales of fake products. Furthermore, the beauty and health products by P&G are majorly for female consumers. In online media presence and leadership, the company is lagging behind.

Opportunity: The organization can develop and supply health and beauty products for men, which can increase the profit level and market share. On the other hand, the firm can leverage its powerful brands and strong name for diversifying into more customer products. Furthermore, P&G can increase organic growth that can boost the global brand image.

Threats: Augmenting and intense rivalry amongst other FMCG firms can affect P&G’s market share. It is evident that the organization is a global brand; economic crisis, recessions and fluctuating exchange rate can impact its business operations. Another threat is that due to increasing raw materials cost, the firm would require to invest huge capital to obtain raw materials.

Learning and Change

P&G systematically assesses its productivity so that potential actions can be taken for further improving and making changes in the organizational performance. The company develops KPIs that support it to measure the outcome and understand what steps can be taken in future to increase business efficiency. Further, it has been identified that the organization allows its workers to be accountable for their own repeated learning and personal development. On the other hand, P&G gives higher emphasis on efficient utilization of resources and pays attention to quality leadership, which supports in creating sustainable learning organization. Action learning approach is adopted by P&G at regular intervals for enhancing decision-making qualities in the workers. In context to change management, it has been observed that P&G has grouped its Global Business Units into four sector-based segments as division of the firm’s ongoing plan for improving business performance. This change has been formally communicated with the employees that helped in gaining willingness of the workers to accept it. Any change plan in the organization is well communicated by the management of the P&G to ensure that each individual staff understands the importance of implementing change for the sake of business and all shareholders. On the other hand, staff are included in the change management programs that support the organization in the implementation of the change successfully. Thus, it can be illustrated that change management is effectively handled by P&G, which assists in better control on performance.

Conclusion and Recommendation

Initially started as a partnership, Procter and Gamble was established as a publicly traded company in 1890. Currently, the company operates with nearly 70 brands in more than 180 countries all over the world while earning net sales worth $65.1 billion. As a result, the company has achieved a respectable rank in the list of popular consumer goods firms highlighted by Forbes, Fortune, Barron and Glassdoor. This success has come to Procter and Gamble since the management team pays much emphasis on the fulfilment of the needs and preferences of employees therefore ensuring their satisfaction and motivation that lead to high productivity of the company. Apart from employees, the management process of Procter and Gamble is capable of addressing the needs and preferences of the local retailers who act as the marketing agents of the company. The company has introduced significant use of digital technology thus enhancing automation of all the operational units of the firms. Thus, it can be illustrated that change management is effectively handled by P&G, which assists in better control on performance.

In spite of the remarkable success in the global consumer goods industry, there are spaces for improvement in the management processes of Procter and Gamble. It has been reported that the company has shifted from its mission, thus failing to provide the appropriate products and services to the global customer base. In order to adhere to the mission statement, the company needs to develop a new business strategy that will help the firm in delivering innovative products to the customers thereby ensuring a better standard of living for the global consumer base. In the process, the firm needs to restructure its research and development process, thus making it capable of designing more profitable and innovative breakthroughs. Moreover, the company needs to target millennial consumer base so as to penetrate more into the developing countries while maintaining customer satisfaction and loyalty in the developed countries. This can be done with the help of innovative technologies of product development and marketing. The company also needs to increase media presence so as to ensure better market penetration while boosting the global brand image. If the aforementioned recommendations can be followed effectively, Procter and Gamble is likely to overcome its current threats in the consumer goods industry.

- Gara, A. (n.d.). The Just 100: America’s Best 100 Corporate Citizens. Retrieved January 12, 2017, from https://www.forbes.com/companies/procter-gamble/

- Kalogeropoulos, D. (n.d.). 3 Ways Procter & Gamble Co. Is Losing to the Competition. Retrieved October 2, 2016, from https://www.fool.com/investing/2016/10/02/3-ways-procter-gamble-co-is-losing-to-the-competit.aspx

- P&G appoints Peltz to board despite losing proxy battle. (n.d.). Retrieved December 18, 2017, from https://www.cnbc.com/2017/12/18/pg-appoints-peltz-to-board-despite-losing-proxy-battle.html

- P&G Details Transformation that is Delivering Strong Results in Shareholder Letter . (n.d.). Retrieved January 20, 2018, from http://news.pg.com/press-release/pg-corporate-announcements/pg-details-transformation-delivering-strong-results-shareho

- How Procter & Gamble Makes Money? Understanding P&G Business Strategy. (n.d.). Retrieved January 27, 2018, from https://revenuesandprofits.com/how-procter-gamble-makes-money/

- P&G Reorganizes into Industry-Specific Sectors. (n.d.). Retrieved January 28, 2018, from https://consumergoods.com/pg-reorganizes-industry-specific-sectors

- Brand value of the leading personal care brands worldwide in 2017. (n.d.). Retrieved January 29, 2018, from https://www.statista.com/statistics/273236/brand-value-of-the-leading-personal-care-brands-worldwide/

- Sales of the leading household/personal care companies worldwide 2016. (n.d.). Retrieved January 29, 2018, from https://www.statista.com/statistics/257973/sales-of-the-leading-household-personal-care-companies-worldwide/

- (2018a). P&G Worldwide Corporate Sites. Retrieved from https://www.pg.com/en_US/worldwide_sites.shtml

- (2018b). Our brands. Retrieved from https://us.pg.com/our-brands

- (2018c). Our purpose, values and principles. Retrieved from https://www.pg.com/translations/pvp_pdf/english_PVP.pdf

- Brown, B., & Anthony, S. (2011, June 1). How P&G Tripled Its Innovation Success Rate. Retrieved from https://hbr.org/2011/06/how-pg-tripled-its-innovation-success-rate

- Warren, S. (2012, April 29). The Strategic Development of Procter and Gamble into a Global Giant. Retrieved from https://wearedevelopment.net/2012/04/29/the-strategic-development-of-proctor-and-gamble-into-a-global-giant/

- Vijayraghavan, K., & Malviya, S. (2014, April 28). Procter & Gamble merges India, the Middle East, and Africa into one IMEA region to improve execution. Retrieved from https://economictimes.indiatimes.com/industry/services/retail/procter-gamble-merges-india-the-middle-east-and-africa-into-one-imea-region-to-improve-execution/articleshow/34305032.cms

- Fernando, J. (2015, October 06). Procter & Gamble Restructures, Sheds 100 Brands . Retrieved from https://www.investopedia.com/articles/investing/100615/procter-gamble-restructures-sheds-100-brands.asp

- Reingold , J. (2016, June 09). Can P&G Find Its Aim Again? Retrieved from http://fortune.com/procter-and-gamble-david-taylor-fortune-500/

- Colvin, G., & Derousseau, R. (2016, July 21). Power Sheet: How P&G Missed Out on Dollar Shave Club’s Rise. Retrieved from http://fortune.com/2016/07/21/power-sheet-how-pg-missed-out-on-dollar-shave-clubs-rise/

- Wahba, P. (2017, February 23). Procter & Gamble Is Shaving the Price of Its Gillette Razors. Retrieved from http://fortune.com/2017/02/23/procter-gamble-razor/

- Terlep, S. (2017, July 17). Activist Attack Puts Focus on Procter & Gamble Cost Cutting. Retrieved from https://www.wsj.com/articles/activist-attack-puts-focus-on-procter-gamble-cost-cutting-1500311483

- Tenebruso, J. (2017, July 25). The Procter & Gamble Company in 7 Charts. Retrieved from https://www.fool.com/investing/2017/07/25/the-procter-gamble-company-in-7-charts.aspx

- Larsen, G. (2017, September 06). A Day In The Life Of A Millennial Sales Rep: Why A.I. Is Causing A Sales Revolution. Retrieved from https://www.insidesales.com/insider/artificial-intelligence/day-life-millennial-sales-rep-causing-sales-revolution/

- Stevens, A. (2017, September 19). Analyzing Procter & Gamble’s Sales. Retrieved from https://marketrealist.com/2017/09/analyzing-procter-gambles-sales

- Orol, R. (2017, September 24). Trian Partner Talks Procter & Gamble Battle, R&D Swiffer Sweepers. Retrieved from https://www.thestreet.com/story/14316552/1/trian-partner-talks-procter-amp-gamble-m-amp-a-r-amp-d-and-swiffer-sweepers.html

- Orol, R. (2017, September 24). Trian Partner Talks Procter & Gamble Battle, R&D Swiffer Sweepers. Retrieved from https://www.thestreet.com/story/14316552/1/trian-partner-talks-procter-amp-gamble-m-amp-a-r-amp-d-and-swiffer-sweepers.html

- Terlep, S. (2017, October 20). P&G, After Slight Sales Gain, Puzzled by Weak U.S. Consumer Spending. Retrieved from https://www.wsj.com/articles/procter-gambles-profit-rises-but-sales-fall-short-of-views-1508500938

- Wilmot, S. (2017, October 20). P&G Does Itself No Favors Post-Peltz. Retrieved from https://www.wsj.com/articles/p-g-does-itself-no-favors-post-peltz-1508518587

- Danziger, P. (2017, October 24). How Can P&G Be So Clueless About What Customers Want? Retrieved from https://www.forbes.com/sites/pamdanziger/2017/10/24/can-pg-be-so-clueless-about-what-customers-want/#5060a942762e

- Danziger, P. (2017, October 24). How Can P&G Be So Clueless About What Customers Want? Retrieved from https://www.forbes.com/sites/pamdanziger/2017/10/24/can-pg-be-so-clueless-about-what-customers-want/#5060a942762e

- Hoium, T. (2018, January 1). Why 2017 Was a Year to Forget for Procter & Gamble Company. Retrieved from https://www.fool.com/investing/2018/01/01/why-2017-was-a-year-to-forget-for-procter-gamble-c.aspx

- Gale, T. (n.d.). Www.encyclopedia.com. Retrieved January 10, 2018, from http://www.encyclopedia.com/social-sciences-and-law/economics-business-and-labor/businesses-and-occupations/procter-gamble-company

- Fiscal 2017 Highlights. (n.d.). Retrieved January 15, 2018, from http://www.pginvestor.com/Cache/1001226104.PDF?O=PDF&T=&Y=&D=&FID=1001226104&iid=4004124

- History of Innovation . (n.d.). Retrieved January 16, 2018, from https://us.pg.com/who-we-are/heritage

- Heritage. (n.d.). Retrieved January 18, 2018, from https://us.pg.com/who-we-are/heritage

- Purpose, Values & Principles . (n.d.). Retrieved January 22, 2018, from https://us.pg.com/who-we-are/our-approach/purpose-values-principles

- Nicolaou, A. (2018, January 24). P&G discount strategy rings alarm bells . Retrieved from https://www.ft.com/content/c3ebb978-0052-11e8-9650-9c0ad2d7c5b5

- Nicolaou, A. (2018, January 24). P&G discount strategy rings alarm bells. Retrieved from https://www.ft.com/content/c3ebb978-0052-11e8-9650-9c0ad2d7c5b5

- External Recognition . (n.d.). Retrieved January 25, 2018, from https://us.pg.com/who-we-are/external-recognition

- Corporate Structure. (n.d.). Retrieved January 28, 2018, from https://us.pg.com/who-we-are/structure-governance/corporate-structure

- Leadership team. (n.d.). Retrieved January 28, 2018, from https://us.pg.com/who-we-are/leadership-team

- Designed to Innovate. (n.d.). Retrieved January 29, 2018, from https://www.pg.com/annualreport2008/letter/leveraging.shtml

- Our Core Strengths. (n.d.). Retrieved January 29, 2018, from https://us.pg.com/who-we-are/our-approach/core-strengths

- Where We Operate. (n.d.). Retrieved January 31, 2018, from https://www.pg.com/en_US/downloads/media/Fact_Sheets_Operate.pdf